Payroll Training

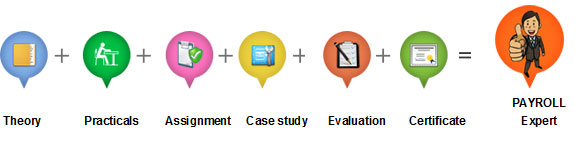

Whether you are new to Payroll or a seasoned practitioner, a professional certification is your professional advantage.

EMPOWERING PEOPLE KNOWLEDGE offers payroll certifications across all the professionals to enhance their knowledge in accounting & payroll process. We give extensive training with our real time experience professionals. In today’s competitive business environment, the payroll professional’s role is becoming increasingly more complex.

EMPOWERING PEOPLE KNOWLEDGE offers payroll certifications across all the professionals to enhance their knowledge in accounting & payroll process. We give extensive training with our real time experience professionals. In today’s competitive business environment, the payroll professional’s role is becoming increasingly more complex.

Increasingly those working in HR and Payroll are playing strategic roles in taking the country’s leading companies and organizations forward within India’s buoyant economy and so in these exciting developmental times it is the perfect opportunity to take advantage of EMPOWERING PEOPLE KNOWLEDGE training and qualification opportunities.

It is vital that there is accuracy and timeliness in payroll production, ensuring not only the correct net pay to employees but computing accurate overheads to ensure accounting accuracy.

Payroll management has also direct linkage to the strict compliance of stringent provisions of large number of complex labor laws prevailing in India. Any non-compliance attracts severe penal consequences. To ensure accurate salary and rewards are paid on time, efficient payroll management is necessary. This will help lead to a satisfied workforce and avoidance of penalties for non-compliance