An investment in your corporate employees through our tailored training pays dividends!

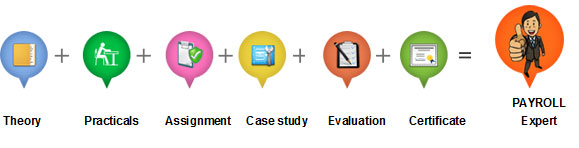

Empowering People Knowledge Corporate HR Payroll Training helps high-potential leaders and teams adopt new paradigms, implement new practices, and achieve competitive advantage and market success through strategic talent management. Our certification program is the gold standard for proving knowledge and successfully implementing solutions to real-world talent and leadership challenges. Our corporate training program will motivate, coach, reward, educate and advance your company.

Get the training advancement you need, no matter the location, number of employees or unique business needs.

We Offer low cost access to high value education and informal learning. Our corporate HR Payroll training program is exclusively for the corporate employees across all industries. HR Payroll is one department that is important in all the sectors and these days it has become even more important for organizations to update their employees about all the recent changes pertaining to employee staffing norms. We at Empowering People Knowledge training, conduct specially designed programs for the corporate employees so that they can get well versed with the latest updates. The course has a vast module that deals with the calculations of Gratuity, bonus, the pay structure, calculation of salaries and many other things. Our aim at Empowering People Knowledge training is to “ We do not Teach, We Train”. More a nd more emphasis is laid on practical instead of theoretical knowledge.

Recognize that learning is part of everything the organization does. Opportunities to learn happen all the time. Organizational cultures that support learning recognize learning as an ongoing process, not an event. A new piece of legislation may be used as a learning tool for all staff. A proposed special event may become a learning opportunity for an employee who has expressed an interest in event management.