No Need to Travel, Attend Face-to-Face LIVE Classes from Anywhere in India Via Skype Web Classes.

- Price – Rs. 4000

- Course type - Online course

- Requirements - Skype, Headphone with mic, Team Viewer ( Set up files of Skype & Team Viewer will be given from Empowering People Knowledge Company )

- Exam is included.

- Certified Payroll Professional Certificate is given

Overview

Web Conferencing is one of the latest technologies used by many universities and corporate for training purpose. The classes for this programme will be held through LIVE lectures that will be beamed online via internet to student desktops/laptops or classrooms using Skype., Team Viewer .

The training will comprise of lectures and case discussions imparted by HR Payroll faculty. Students can chat real time with the faculty during the live class and Online Training Contents will be same as of Advanced Payroll Training.

Technology has grown by leaps and bounds and no place on this Planet is non-contactable as long as it has internet connectivity. There are various methods and tools to get connected like Skype, Team Viewer etc. It has been observed that many young professionals and aspirants want to get enroll themselves in our prestigious courses but they are remotely located. Well, for students and professionals like these, we have now an online course. The curriculum of the course would be same as its physical version, but the difference would be only that, you can study and learn even from your location. This course covers all the relevant topics that are related to HR Payroll practices and norms.

For Executives who are unable to come down to Bangalore, we have an easier option called Online Training, where it is possible for them to take up the course online. This online training is exclusively designed to bridge the gap and helps the executives to take up training from any corner of the country at their ease of flexible timings.

Further this online training, is through voice chatting and will be similar to the class room training and you will not be missing any important part of the training.

Time allotments for voice chatting will be flexible and could be any time between Monday to Sunday which is comfortable for you and our faculty’s time schedule.

Who is it for?

Want to open the door to working in Payroll / HR? Starting our Payroll & Compliance Course Computerized Payroll for Business will enhance your career potentials and give you the skills and knowledge you need to get started in HR /Payroll.

Payroll is a vital role within any organization. A career in payroll means specializing in a niche field with excellent progression opportunities.

What jobs will I qualify for?

- Payroll Executive

- Payroll Team Leader

- Payroll Manager

- HR Executive

- Compensation Manager

When can I start?

You can Enroll at any time – Start today.

Are there any requirements?

There are no formal entry requirements for this course. keen interest in payroll/HR is desirable.

You will need a PC/Laptop with Window XP(SP3) operating system or higher, Camera if possible, Headphone with mic, .& 1 mbps Internet Speed ,Rough Book for Calculation.

What skills will I gain?

Our Computerized Payroll for Business course will teach you how to:

- Prepare the payroll

- Compose an employee payroll record

- Make Gross Pay /Net Salary calculations

- CTC Breakup /Salary Breakup

- Leave Management

- Deduct statutory (PF,ESI, PT,LWF,TDS) and non-statutory payments

- Work with Excel

- Statutory Compliances Govt .Online Filing

- Computerized payroll skills

- Employment legislation for payroll

- Statutory and non-statutory reporting of payroll data

- Income tax and Statutory Contributions

Training Mode: On-line.

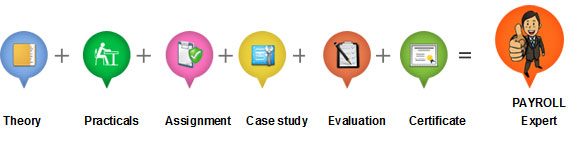

Training Methodology: Real-time Project oriented.

Training Features:

- Trainers from Corporate

- Valid Materials(Soft/ Hard Copy)

- Live Scenarios